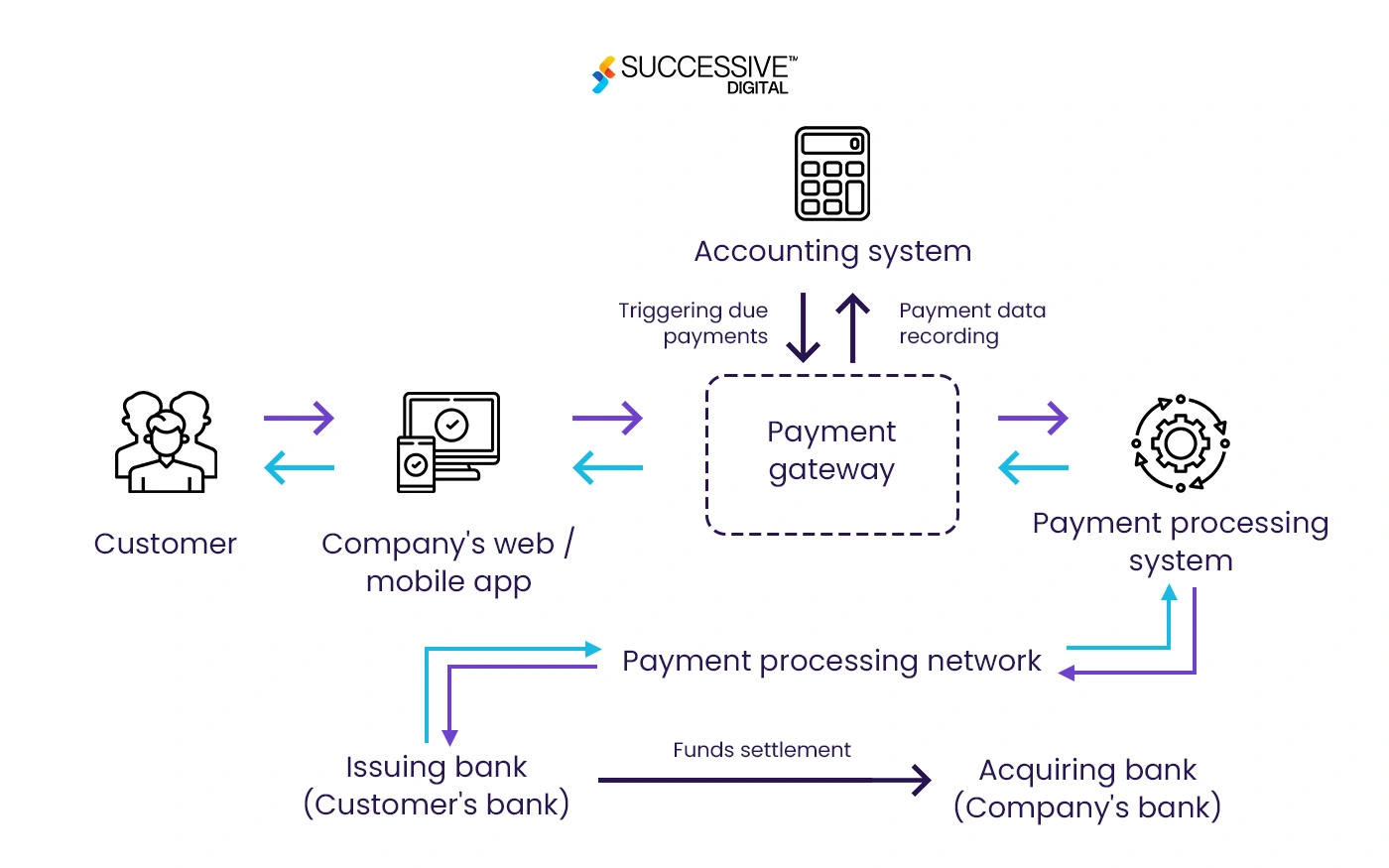

Payment gateway integration is essential for online businesses, enabling them to accept payments globally through numerous channels like cards and digital wallets. The system is complex, concerning technical, costs, and skill issues. Every step needs a cautious strategy, from deciding on an appropriate gateway provider to API integration, development, protection, and testing. Understanding cost implications is vital for budgeting. The technical skills required span programming, safety, and DevOps, ensuring seamless, secure integration.

This blog explores the unique roadmap for payment gateway integration, explores the diverse costs involved, and highlights the critical skills required. It presents a comprehensive guide for businesses embarking on this important journey.

Roadmap for Payment Gateway Integration

-

Requirement Analysis and Selection

The first step in payment gateway integration is to analyze the business requirements and pick a suitable gateway provider. Key factors to keep in mind include:

- Transaction Volume: Estimate the number of transactions your business expects to process daily, monthly, and annually.

- Geographical Scope: Determine whether you need a payment gateway that supports international transactions or just domestic ones.

- Payment Methods: Identify the payment methods you wish to support (credit cards, debit cards, digital wallets, etc.).

- Security Standards: Ensure the payment gateway complies with security standards such as PCI DSS (Payment Card Industry Data Security Standard).

- Fee Structure: Compare the fee structures of different payment gateways, including setup fees, transaction fees, and monthly maintenance fees.

- Integration Support: Evaluate the ease of integration, availability of APIs, SDKs, and developer documentation.

Popular payment gateways include PayPal, Stripe, Square, Authorize.Net, and Adyen.

-

Account Setup

Once the payment gateway integration service is chosen, the next step is to install a service provider account. This entails registering with the provider, completing the essential verification process by submitting enterprise and financial details, and acquiring API keys or tokens for authenticating and processing transactions securely within the application or website.

-

Environment Setup

Setting up the development ecosystem includes configuring the necessary tools and frameworks to facilitate payment gateway API integration:

- Sandbox Environment: Use the payment gateway’s sandbox environment for testing purposes without processing actual transactions.

- Development Tools: Set up IDEs, version control systems (e.g., Git), and other necessary development tools.

- Frameworks and Libraries: Install relevant libraries and SDKs provided by the payment gateway for easier integration.

-

Integration Process

The payment gateway integration process involves numerous critical steps to ensure seamless transaction processing. Start by integrating the payment gateway’s API into the utility, which includes putting in authentication using API keys or OAuth tokens and enforcing endpoints for payment initiation, authorization, and capture.

Next, focus on the front-end integration with the help of embedding the gateway’s UI components, making sure responsive layout and robust form validation. On the back-end, manage server-side processing of payment records, manage orders, and implement important security features like data encryption and tokenization. Comprehensive testing, including unit, integration, and end-to-end tests, ensuring the gateway works perfectly within the system.

-

Testing

Thorough testing ensures the integration works seamlessly by identifying and resolving capacity problems earlier than deployment. This includes unit checking for components, integration among various modules, end-to-end testing to simulate actual transactions, and safety testing to guard against vulnerabilities.

-

Deployment

After successful testing, the payment gateway integration services are deployed to the production environment.

- Configuration: Configure the payment gateway settings for the business surroundings, such as API keys and endpoints.

- Monitoring: Set up monitoring tools for tracking transaction performance, errors, and other vital metrics.

- Backup Plans: Implement backup and recovery plans to deal with unexpected problems during transaction processing.

-

Maintenance and Updates

Maintenance and updates are essential to keep the payment gateway API integration secure and efficient. This involves applying security updates to address vulnerabilities, integrating new features from the payment gateway provider, optimizing performance, and continuously monitoring transaction processes to ensure smooth and reliable payment operations. Regular maintenance ensures long-term functionality and compliance.

Costs of Payment Gateway Integration

The cost to integrate payment gateway encompass various factors. Initial setup fees may include cost for creating a service provider account and development charges. Transaction expenses, charged per transaction, and monthly expenses for maintenance are ongoing charges.

Additionally, businesses might spend money on fraud prevention tools and compliance measures, incurring extra expenses. Hidden fees, which include forex charges and chargeback costs, also contribute to the overall expenses. Understanding these expenses is vital for budgeting and planning to ensure a continuing integration system without unexpected financial burdens.

Skills Required for Payment Gateway Integration

Payment gateway integration demands a blend of technical competencies. Proficiency in programming languages like JavaScript, Python, or PHP is essential for API integration and non-stop improvement.

Front-end capabilities, which include HTML/CSS and JavaScript, are essential for UI integration and form validation. Knowledge of data protection satisfactory practices, which provides data encryption and compliance with standards like PCI DSS, ensures seamless and secure transactions.

Testing skills, including unit testing and end-to-end testing, are vital for identifying and resolving issues. Understanding DevOps practices helps seamless deployment and monitoring. Conversation and trouble-fixing skills are also valuable for collaborating with teams efficiently and addressing any challenging situations.

A holistic talent and skill set-up spanning programming, protection, testing out, and collaboration enables developers to navigate the complexities of payment gateway integration and supply robust, secure, and efficient solutions that meet the desires of businesses and customers alike.

Conclusion

Payment gateway integration is a multi-faceted procedure that requires cautious planning, execution, and ongoing maintenance. By following a structured roadmap, information on the associated costs, and taking advantage of essential technical skills, businesses can ensure a stable and efficient payment processing set-up. This integration enhances the consumer experience and builds belief and credibility, ultimately driving the brand’s success in the online world.