In the modern era marked by rapid technological development, the worldwide insurance industry unearths itself at an essential juncture of transformation. The intersection of digital evolution and the AI era is reshaping traditional insurance methodologies while paving the way for progressive approaches. As insurers navigate the complexities of this evolving landscape, AI language models emerge as a catalyst with profound implications.

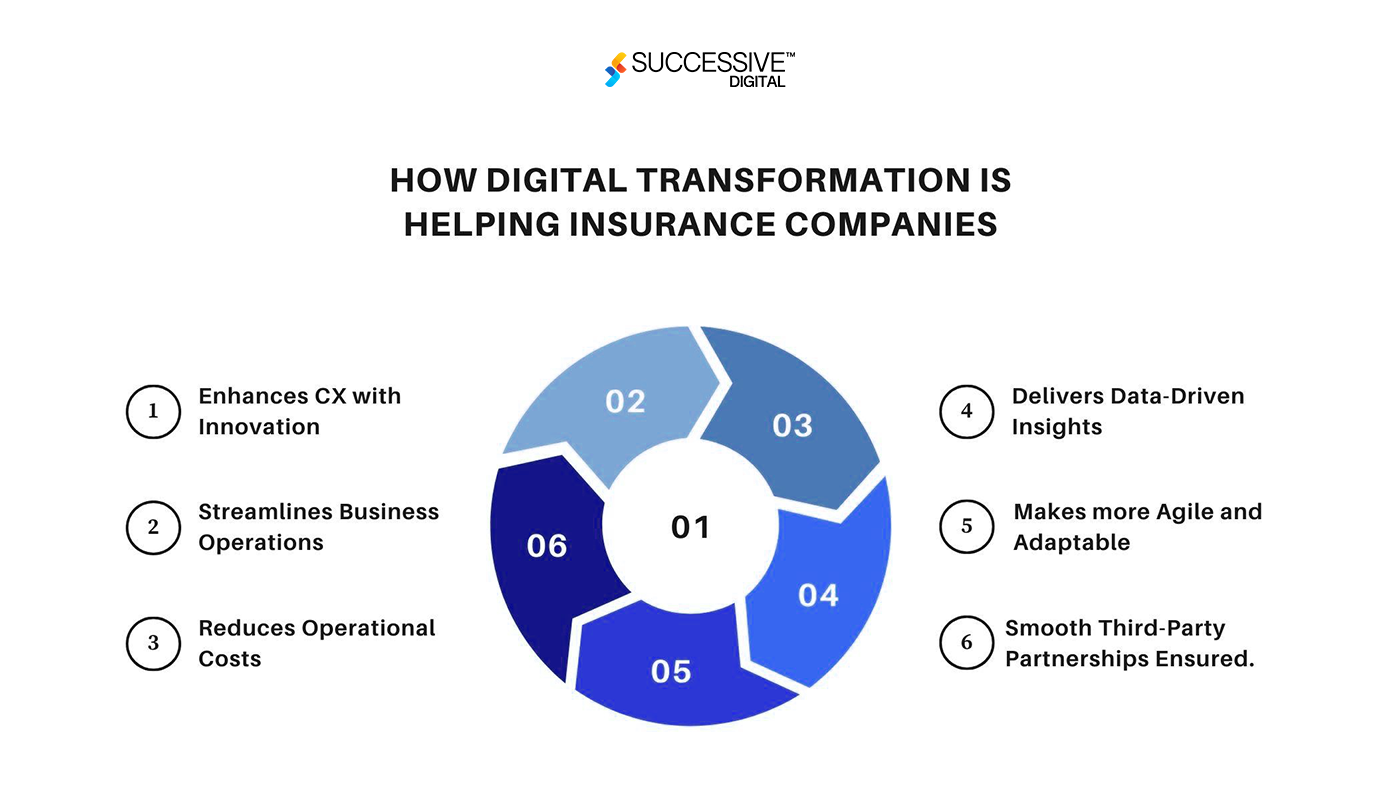

The digital transformation in the insurance industry has brought significant modifications throughout industries, influencing consumer behaviour, market dynamics, and operational frameworks. This modification is propelled via rising customer expectancies, exponential data growth, and the imperative for more desirable operational efficacy in the insurance realm. Consequently, insurers are increasingly adopting digital solutions to streamline processes, bolster risk management, and offer tailored offerings to policyholders.

AI language models have emerged as pivotal drivers of innovation, demonstrating extraordinary skills in natural language processing (NLP), text analysis, and contextual comprehension. These sophisticated AI systems, skilled in tremendous repositories of textual data, possess the ability to realize, generate, and manage human-like language with staggering fluency. The capability applications of AI language models inside the global insurance industry are far-reaching and transformative, encompassing superior customer interactions, subtle underwriting methods, better claims coping with modern product development, and adherence to regulatory requirements.

Digital Transformation in the Insurance Industry:

Before delving into the precise functions of AI language models, it is crucial to recognize the broader context of digital transformation within the insurance space. Over the last decade, insurance agencies followed digitalization to streamline approaches, boost performance, and decorate client experience. Several elements have driven this transformation:

- Changing Customer Expectations: Today’s customers count on seamless virtual interactions and personalized offerings from their coverage companies. To remain competitive, insurers should adapt to these evolving expectations.

- Data Proliferation: The proliferation of statistics from diverse resources, including IoT devices, social media, and other digital structures, presents insurers with demanding situations and possibilities. Leveraging these statistics correctly calls for state-of-the-art analytical tools, including AI.

- Operational Streamlining: Digital technology provides avenues for automating habitual duties, slicing down operational charges, and boosting the efficiency of strategies together with underwriting, claims processing, and hazard assessment.

- Addressing Emerging Risks: As new risks emerge, such as cyber threats and climate change-related incidents, insurers require sophisticated analytical capabilities to evaluate and manipulate them.

Role of AI-Language Models in Insurance:

AI language models, including OpenAI’s GPT (Generative Pre-educated Transformer) collection, have garnered interest for their capacity to recognize, generate, and manage human-like textual content. These models, educated on substantial quantities of textual data, excel in tasks such as natural language understanding, text generation, sentiment analysis, and more. In the insurance organizations, AI language models hold immense potential in the following ways:

-

Underwriting and Risk Assessment

These critical functions of the insurance industry include comparing capacity policyholders’ threat profiles and determining suitable coverage and premiums. AI language models can revolutionize this procedure by studying enormous volumes of data, along with historical claims statistics, demographics, and market developments.

By extracting insights from unstructured data resources, which include medical records, social media activity, and news reports, AI language models can enhance the accuracy of risk assessment, discover emerging trends and risks, and, ultimately improve the underwriting decisions, leading to extra competitive pricing and tailor-made insurance alternatives for policyholders.

-

Claims Processing

Claims processing is another area apt for AI-driven digital transformation in the insurance industry. AI language models can analyze claim bureaucracy, correspondence, medical reports, and other applicable documents to expedite the claims adjudication technique. By automating recurring tasks and flagging doubtlessly fraudulent claims, these models can reduce processing times, reduce errors, and enhance normal efficiency.

-

Product Development and Innovation

In the competitive landscape of the insurance industry, staying ahead calls for continuous innovation. AI language models play a pivotal role by providing valuable insights derived from analyzing big datasets. These insights inform the development of new insurance products tailored to evolving customer wishes and global market trends.

By analyzing customer feedback, market studies, and competitor services, insurers can discover rising opportunities and find innovative solutions that cope with the unmet wishes of the clients. AI-driven predictive analytics also enable insurers to anticipate major risks and market shifts, empowering them to proactively adapt their product and services to stay ahead of the curve.

-

Regulatory Compliance

Compliance is a top priority for insurance companies in increasingly complex regulatory environments. AI language models can assist in monitoring regulatory modifications, analyzing legal documents, and ensuring compliance with applicable laws and rules. By automating compliance assessments and flagging potential troubles, these models can help insurers mitigate regulatory risks and avoid steeply-priced penalties.

-

Customer Interactions and Support

AI language models can revolutionize customer interactions by imparting personalized and contextually applicable guidance. Chatbots powered by AI language models can manage consumer queries, offer insurance information, help with claims, or even facilitate insurance purchases. These digital assistants can function round the clock, providing timely assistance to policyholders and improving customer satisfaction.

Technical Potential of AI-Language Models:

Scalability:

AI language models require vast computational sources for training and inference. Insurers must invest in scalable infrastructure and cloud computing offerings to enable the deployment of AI models at scale.

Data Security and Privacy:

Given insurance statistics’ sensitive nature, ensuring data protection and privacy is paramount. Insurers must implement robust encryption, access controls, and data anonymization strategies to shield customer information and comply with regulatory requirements.

Model Explainability:

As AI models become increasingly important in decision-making strategies, ensuring transparency and explainability is crucial. Insurers must adopt strategies to decipher and explain version predictions to build agreements with customers and the regulatory government.

Ethical Considerations:

AI language models can inadvertently perpetuate biases in training data, leading to unfair results. Insurers must proactively address moral issues and enforce measures to mitigate bias, promote fairness, and uphold moral requirements in AI deployment.

The horizon of possibilities for AI language models in the global insurance industry is expansive and transformative. As insurers navigate the complexities of an unexpectedly evolving landscape, the emergence of this superior AI technology affords unprecedented opportunities for innovation and growth.

By embracing AI responsibly and leveraging its potential effectively, insurers can unlock new avenues for reinforcing client experiences, optimizing operations, and using competitive advantage. However, knowing this capability necessitates considering technical, ethical, and regulatory challenges. With a strategic approach and a commitment to accountable AI deployment, insurers can harness the electricity of AI language models to form the future of coverage, handing over extra price and resilience in an increasingly more digital world.